iedge s reit

Bloomberg SGX data as of 31 January 2022 Price Return Indices. Get detailed information on iEdge S-REIT Index REITSI including stock quotes financial news historical charts company background company fundamentals company financials insider trades annual reports and historical prices in the Company Factsheet.

Csop Iedge S Reit Leaders Index Etf Poems

Lets find out more about this new exchange-traded fund ETF that tracks a real estate investment trust REIT.

. 4 Things About The CSOP iEdge S-REIT Leaders Index ETF SRTSRU To Know Before Investing 3. The Sub-Fund is a passively managed index-tracking ETF with an investment objective of replicating closely the performance of the iEdge S-REIT Leaders Index the Index. IEdge S-REIT Index - Singapore Exchange SGX We use cookies to ensure that we give you the best experience on our website.

Their business is recorded as DOMESTIC BUSINESS CORPORATION. Search Ctrl K. 11E NEW YORK NEW YORK 10016.

CSOP iEdge S-REIT Leaders Index ETF factsheet. If you click Accept Cookies or continue without changing your settings you consent to their use. As of 25 Jun 2022 NAV - 09497 Expense Ratio - Nil.

SGXREIT trade ideas forecasts and market news are at your disposal as well. SGX as of 30 June 2021 6 Source. To learn more about how we collect and use cookies and how you configure.

The iEdge S-REIT Leaders Index is a narrow tradable adjusted free-float market capitalisation weighted index that measures the performance of the most liquid real estate investment trusts in Singapore in SGD. In other words the yield can be a great hedge against rising inflation as well. SINGAPORE November 11 2021--CSOP Asset Management will list its second Exchange-Traded Fund ETF on SGX - CSOP iEdge S-REIT Leaders Index ETF Stock Code.

When compared to other REIT indexes the iEdge S. For the case of CSOP iEdge S-REIT Leaders Index ETF it comprises a total of 28 of the most liquid REITs with a total net asset value of S1169m As the top 10 constituents comprise a huge weightage towards the entire ETF at 7729 and they are as follows with its weightage at the time of writing this post in brackets along with a brief. From 2017 to 2021 the iEdge S-REIT Leaders Index has been generating consistent annual dividend yield of 46 58.

It has delivered an annualised return of 992 in the past 5. 4912057 was incorporated on 03142016 in New York. Before you think about investing in the CSOP iEdge S-REIT Leaders Index ETF here are 4 things about the ETF that you should first know.

Proxied by iEdge S-REIT Leaders SGD Index Total Return 4 Source. Correspondingly the manager. Free and open company data on New York US company IEDGE CONSULTING CORP.

The iEdge S-REIT Leaders Index isnt new in fact it has been around since 2014. SRT - CSOP iEdge S-REIT Leaders ETF Price Holdings Chart more for better stock Trade investing. Track record is just as important for picking Singapore REITs ETF.

It is a market capitalisation weighted index that tracks the performance of the most liquid REITs in Singapore. The fund tracks the performance of the iEdge S-REIT Leaders Index which mostly comprises S-REITs. Singapore REITs A Reopening Story.

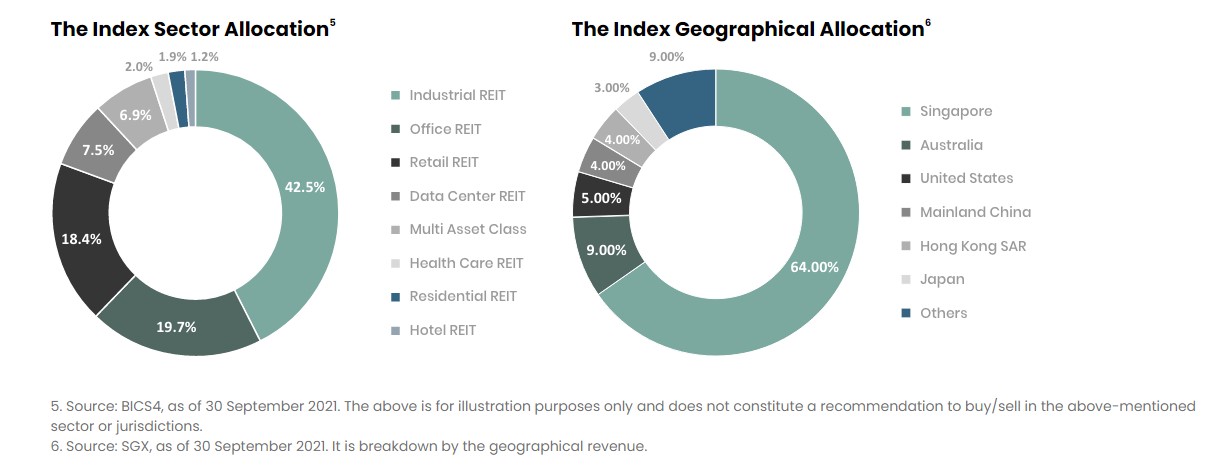

SGX as of 30 September 2021 5 Source. 6 Correlation Matrix Between SREITs and Other Asset Classes Asia Indices 1 FTSE ST REIT Index 2 iEdge S-REIT Index. The CSOP iEdge S-REIT Leaders Index ETF is a Sub-Fund of the CSOP SG ETF Series I Unit Trust.

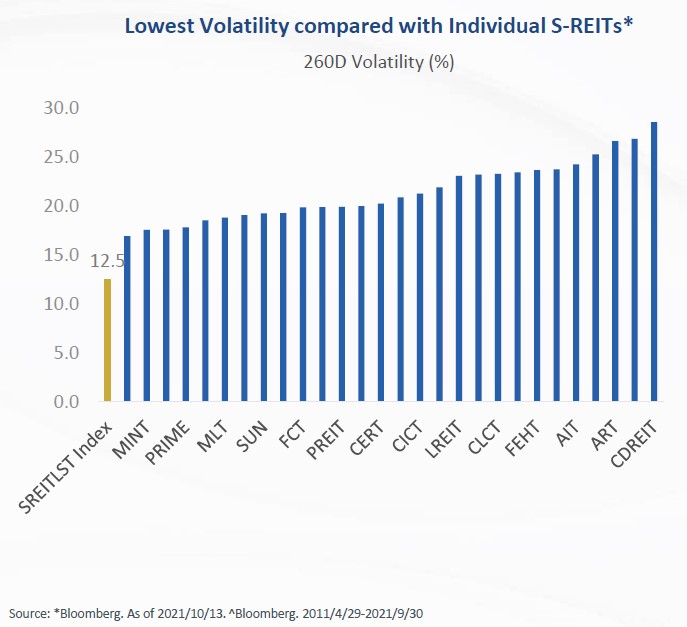

See more on advanced chart Markets Indices. IEdge S-REIT Leaders SGD Index - Historical performance as of 30 Sep 2021 Source. The ETF has several unique characteristics which stand out in particular.

The funds manager applies an indexing-investment strategy or passive management to track its performance. REIT invests in 20 of Singapores largest REIT. Subscribe to our emails.

Access Real Estates Historically Consistent Return Potential With Fundrise. You can change your settings at any time. Ad Over 160 Million Net Dividends Earned By Investors Since 2014.

A real estate investment trust in Singapore S-REIT A fund on SGX that invests in a portfolio of income generating real estate assets such as shopping malls offices or hotels usually with a view to generating income for unit holders of the fund. IEDGE S-REIT INDEX REIT. Get CSOP iEdge S-REIT Leaders Index ETF CSOP-SGSingapore Exchange real-time stock quotes news price and financial information from CNBC.

Company Info DOS ID. SGX as of. Find the latest information on iEdge REIT REITSI including data charts related news and more from Yahoo Finance.

The CSOP iEdge S-REIT Leaders Index ETF has a management fee of 05 and a total expense ratio of 06 which is capped and would be deducted annually as fees. The Companys current operating status is Active. Bloomberg CSOP 6 May 2016.

Furthermore it is projected to generate 54 and 56 yield for 2022 and 2023 respectively. View live IEDGE S-REIT INDEX chart to track latest price changes. Designed for investors seeking passive income youll get exposure to REIT like Mapletree Commercial Trust CapitaLand.

The index measures the performance of the most liquid REIT in Singapore. The CSOP iEdge S-REIT Leaders Index ETF is a sub-fund of the CSOP SG ETF Series I a Singapore unit trust. Company number 4912057 300 E.

The Open Database Of The Corporate World. Learn how to leverage transparent company data at scale. Syfe REIT is a Singapore REIT portfolio that tracks the SGXs iEdge S-REIT Leaders Index.

Figures indexed at 100 as of Sep 2010 base date of iEdge S-REIT Index Source. Theres going to be a new kid on the REIT ETF block giving investors another option to invest in Singapore REITs seamlessly. Come towards the end of November CSOP iEdge S-REIT Leaders Index ETF will start trading on the Singapore Exchange SGX.

The CSOP iEdge S-REIT Leaders Index ETF is available in two main currencies SGD and USD. Nikko AM-Straits Trading AXJ REIT ETF. For the case of CSOP iEdge S-REIT Leaders Index ETF it comprises a total of 28 of the most liquid REITs with a total net asset value of S1169m As the top 10 constituents comprise a huge weightage towards the entire ETF at 7729 and they are as follows with its weightage at the time of writing this post in brackets along with a brief.

Csop Iedge S Reit Leaders Index Etf What Investors Should Know About This New Reit Etf

Csop Iedge S Reit Leaders Index Etf Invest In This Etf For Stable Dividend Yield No Money Lah

Csop Iedge S Reit Leaders Index Etf To List On Sgx

Index Update Sgx S Iedge S Reit 20 Index Will Become The Iedge S Reit Leaders Index

S Reit Report Card Here S How Singapore Reits Performed In Fy2018

Constituents Of The Iedge S Reit Index Companies Markets The Business Times

Csop Iedge S Reit Leaders Index Etf Invest In This Etf For Stable Dividend Yield No Money Lah

Syfe Reit Vs Csop Iedge S Reit Leaders Index Etf Which Reit Investment Should You Choose

Csop Iedge S Reits Leaders Etf Stock Code Srt Sru Hardwarezone Forums

Csop Iedge S Reit Leaders Index Etf Invest In This Etf For Stable Dividend Yield No Money Lah

Index Update Sgx S Iedge S Reit 20 Index Will Become The Iedge S Reit Leaders Index

S Reits Punching Above Its Weight In The Global Arena Syfe

Csop Iedge S Reit Leaders Index Etf What Investors Should Know About This New Reit Etf

Csop Iedge S Reits Leaders Index Etf Riding The Wave With S Reits Leaders Youtube

Does Inflation And Rising Interest Rate Affect Reits Featuring Csop Iedge S Reit Leaders Index Etf Edition

4 Things About The Csop Iedge S Reit Leaders Index Etf Srt Sru To Know Before Investing

Why Singapore Reit Investors Should Consider Investing Via The Iedge S Reit Leaders Index

4 Things About The Csop Iedge S Reit Leaders Index Etf Srt Sru To Know Before Investing

Reits Report Card 2021 How Singapore Reits Performed In 2nd Quarter 2021

Comments

Post a Comment